-

Commentary

History of Totals: How Sports Betting Totals Evolved

March 12, 2024Betting on totals, also known as "totals," represents one of the most intriguing forms of sports betting, defined...

-

Commentary

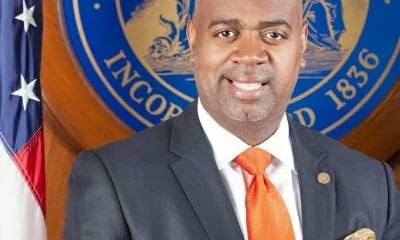

The Struggle To Create Peace In the Streets Under Newark NJ’s Mayor Ras Baraka

July 6, 2023By Bashir Muhammad Akinyele Last week while I was vacationing in Virginia Beach, Virginia from a long...

-

Commentary

Bashir Akinyele: To All of Mayor Ras J. Baraka’s Enemies

July 6, 2023By Bashir Muhammad Akinyele I just would like to know where were you back in the late...

-

Commentary

Dr. Sinclair N. Grey III – Screw Fake Apologies From White Racist

March 29, 2023How many times will white racist continue to make despicable and deplorable comments towards African-Americans? Here’s...

-

Commentary

Dr. Martin Luther King, Malcolm X, Faith, Good Deeds, Black Cultural Pride and a Movement for Social Justice

March 27, 2023By Bashir Akinyele This past January, America, and the world, observed the life and legacy of the...

-

Commentary

Dr. Sinclair N. Grey III – Trump And His Fascist Puppets – The Republican Party

March 22, 2023Let’s face it – the presidency of Donald Trump is not one of power and influence...

-

black history

What’s in a Name?

March 20, 2023By Bashir Akinyele The Most Honorable Elijah Muhammad (NOI), one of the Afrikan American founders of the...

-

Commentary

Dr. Sinclair N. Grey III – Black Empowerment: Today, Tomorrow, And Forever

March 19, 2023The presidency of Donald J. Trump has morphed into a system that seeks to promote white...

-

KK original

Trump And Nazi Billboard Got Something In Common

March 19, 2023By Dr. Sinclair N. Grey III Is President Donald Trump a racist? Do you believe that...

-

Commentary

My Struggle to Become a Muslim, a Blackman, A Father, A Husband and a Community Activist

March 15, 2023By Bashir Muhammad Akinyele Often I think about my path to Al-Islam, Black consciousness, and community activism...

-

Commentary

Doshon Farad: I am a proud “Hotep”

March 14, 2023By Doshon Farad For centuries we witnessed a worldwide assault on black culture by white writers...

-

Uncategorized

White Students Walk Out Of College Lecture After Hearing That All Humans Have African Ancestry

October 21, 2022By Ryan Velez The Grio reports that the discussion of the origins of the human race...

-

Life

DNA Evidence Proves That The First People In China Were Black

December 21, 2019By Daphne R China is apparently finding out now what Black historians have been reporting for...

-

Latest Posts

Mo. Man Arrested After Telling Black Waitress He Wanted to Show Her Where He ‘Hung’ Her Grandpa

January 30, 2021Nodaway County Prosecuting Attorney Robert Rice on Wednesday announced that he has filed a felony assault...

-

black history

Noam Chomsky: White People’s Fear Of Revenge For Slavery Is ‘Deeply Rooted In American Culture’

March 21, 2021April V. Taylor Renowned linguist and activist Noam Chomsky has been speaking with philosopher George Yancy...

-

Commentary

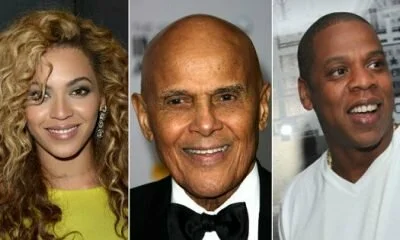

Harry Belafonte Calls Out Jay-Z and Beyonce for Selfishness

August 8, 2018by Dr. Boyce Watkins, KultureKritic.com Harry Belafonte, who did a great deal of work for the...

-

KK original

Are Black People’s Organs Being Stolen For Profit?

May 10, 2021April V. Taylor In a 2006 article, USA today estimated that more than 16,800 families had...

-

News

Brandon Jackson Defends Himself Against White Mob, Sentenced to 12 Years in Prison

December 5, 2018Brandon Jackson was reportedly jumped by 7 or 8 white men in 2006. One would think...

-

Commentary

Poem about Incarceration: “Born to Serve Time”

March 29, 2019Why did a jail cell have to be my fate? Jail is hell within the confines...

-

black history

VIDEO: White Parents, Fox News Demand School Apologize For Black History Month Program

March 22, 2021April V. Taylor Two white parents from Virginia, Rebecca and Charles, recently appeared on the Fox...

-

KK original

Why One Black Civil Rights Hero Is Voting For Donald Trump

October 25, 2022By: Giovanni Zaburoni The demographics of the Democratic and Republican parties have changed since slavery was...